Compliance

No Surprises Act Summary: what your small healthcare practice must do

The irony of the No Surprises Act is that it surprised many healthcare practitioners!

Unfortunately…

- It wasn’t widely publicized before it came into force

- Most information is written for large healthcare organizations, not small practices

- You need to comply immediately, even though there hasn’t been much time to prepare

But don’t panic! We’ve created a simple summary with everything you must do to comply. Plus, we’ve included some templates to make the process easier.

Be aware if you have uninsured/self-pay clients there are extra steps to add to your intake process. And if you don’t comply, you’ll open yourself up to billing disputes that can disrupt your practice. Not to mention your peace of mind.

So what exactly is the No Surprises Act?

You’ve probably heard the horror stories, or perhaps you’ve experienced them yourself…

A patient goes in for a medical procedure expecting it to be covered by their health insurance. Months later, they get a massive bill from an anesthesiologist who wasn’t in their insurance network. The patient never had the chance to choose a network provider their insurance would have covered. Once that bill came in the mail, there was little they could do but pay.

The No Surprises Act (sometimes called NSA) puts an end to surprise bills by requiring upfront cost estimates. This allows patients to find someone else if they don’t want to pay the out-of-network amount.

The horror story of an astronomical hidden bill isn’t likely to apply to your small practice. Even so, the No Surprises Act affects all healthcare practitioners who have clients that don’t use insurance. This ensures that no one receives healthcare services without a clear understanding of the cost.

Here are the three main points all practitioners need to know about this law:

- It applies if you have clients who don’t use insurance

- It gives your clients an upfront estimate of how much your services will cost

- It gives clients the ability to easily dispute medical bills

Understanding the Good Faith Estimate

If you have clients who don’t use insurance, you’ll need to give them a Good Faith Estimate (GFE).

|

What is a Good Faith Estimate (GFE)? A GFE is an estimate of how much your services will cost your client for the next 12 months. |

Still, you may want to give them to all your clients, not just the uninsured. Just because a client tells you they plan to use insurance doesn’t mean they will.

What needs to be in your Good Faith Estimate?

- The patient’s name and date of birth

- Description of service(s) and diagnosis codes

- Payment rates for each item of service

- Frequency of visits

- Diagnosis – You can put “Unknown” if you haven’t seen the client yet. Then, issue a replacement GFE with the correct diagnosis after the first appointment

- Your name, National Provider Identifier, Tax Identification Number (TIN), and the state(s) and office or facility location(s) where you will provide the services

- Disclaimer 1 – You need to put a statement on your GFE declaring that it’s only an estimate, not a contract, and doesn’t include unexpected costs

- Disclaimer 2 – This disclaimer lets your clients know that they can dispute a bill if it exceeds the GFE by at least $400

A Good Faith Estimate is not a contract

You might feel like you’re putting together a contract when you issue a GFE. Rest assured, a GFE is nothing like a contract. It doesn’t guarantee that you will provide services or that your client will use them. It’s only an estimate and must be reissued if anything changes.

Deadlines for delivering a Good Faith Estimate

- If an appointment is 10 or more business days away, provide a GFE within 3 business days of making the appointment

- If an appointment is 3-9 business days away, provide a GFE within 1 business day of making the appointment

- If your client requests a GFE, it must be sent within 3 business days

Do clients have to sign a Good Faith Estimate?

The No Surprises Act doesn’t require your client to sign the Good Faith Estimate. However, you still have to note in their medical record that you gave it to them and they received it.

Use a Good Faith Estimate template

If you provide services to self-pay clients, you’ll be sending out a lot of Good Faith Estimates. And that could be time consuming!

A GFE template can streamline the process, making sure you include all the required information while maintaining a professional image.

There are three main ways you can create a GFE template – as a paper form, a PDF, or a secure web form.

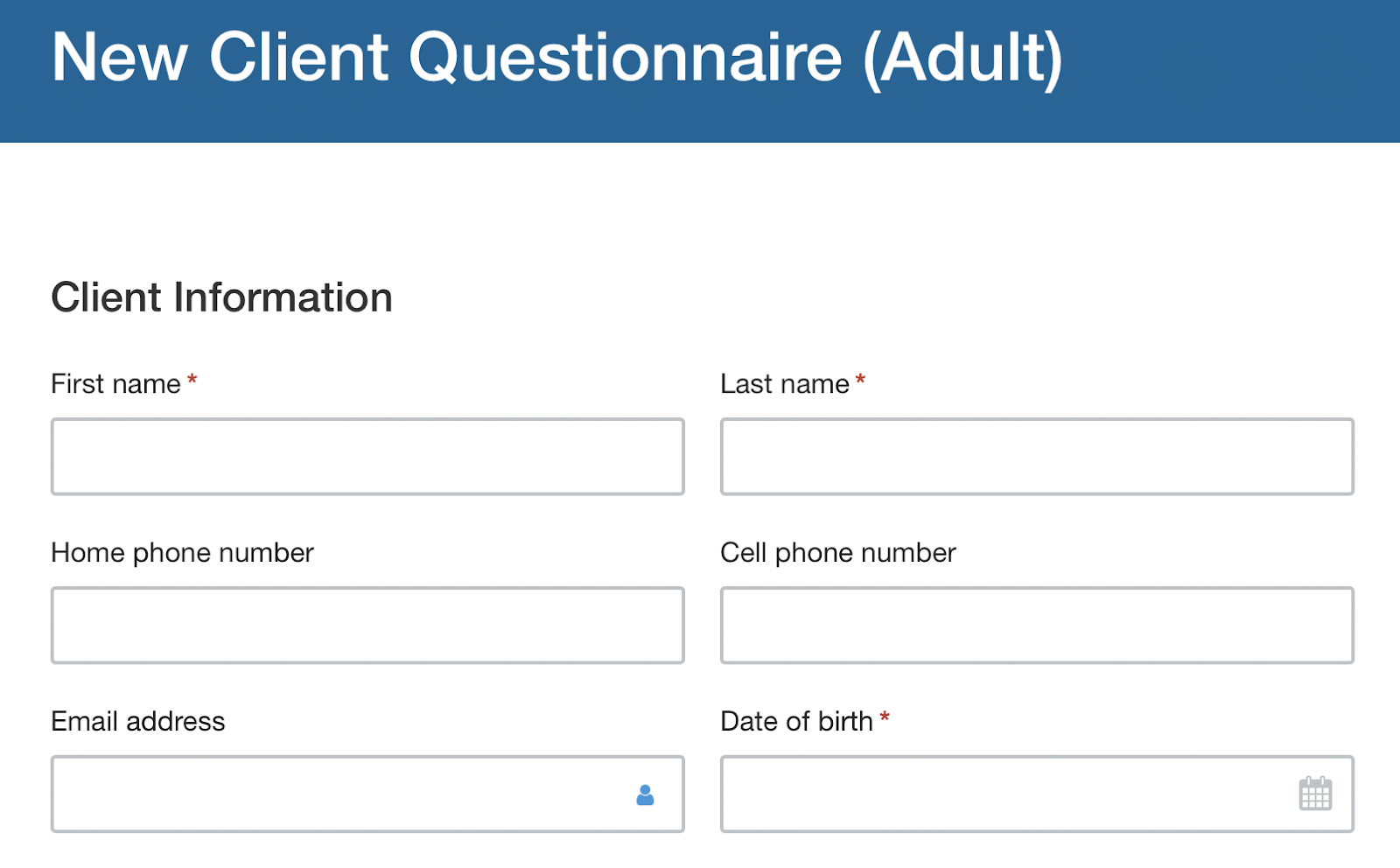

What’s a secure web form?A web form is a form your clients fill out and submit online. A secure web form keeps your clients’ information confidential while it’s online. Here’s an example:  |

This is how the three options compare, and why we’d advise you to use a secure web form for your Good Faith Estimates:

| Secure Web Forms | PDFs | Paper Forms |

| ✅ Fill out on any device | ❌ Requires software to fill out | ❌ Easily lost or damaged |

| ✅ No software required | ❌ Or requires a printer and scanner | ❌ Requires physical storage |

| ✅ You can require responses | ❌ Pre-sized fields limit responses | ❌ Often hard to read or incomplete |

| ✅ Easy to edit | ❌ Difficult to make changes | ❌ Difficult to make changes |

| ✅ Secure |

Useful read: Why you should never send your clients PDFs to fill out.

To make complying with the No Surprises Act as easy as possible, we’ve created a secure web form template that will simplify the process.

It provides the security a document like this requires.

It’s easy for you and your clients to fill out, making the entire process stress-free for both of you.

No printing, scanning, or complicated software required! And it provides electronic proof that you sent the GFE.

If you’re already our customer, you can find the template in your Form Builder. If you’re not yet a customer, you can sign up and start using the template today.

If you don’t use our template, Centers for Medicare and Medicaid Services (CMS) provides a Good Faith Estimate template that most small practitioners will be able to use. However, keep in mind that it’s a PDF with all the disadvantages listed above.

If you send it to your client through snail mail, don’t forget, you have three days at most to deliver a GFE after you make the appointment.

If you decide to send it by email, think about that…

Do you really want to require a new client to figure out how to print, scan, and email back your form?

Not everyone has a printer and scanner in their home.

Also, is it secure? GFEs contain PHI that needs to be protected.

That said, if you’re not ready to take the plunge with Hushmail, the CMS template will give you what you need to support your compliance. You can always check us out again later.

Publish this No Surprises Act information on your website

Right to receive a Good Faith Estimate

You need to state that the client has the right to receive a Good Faith Estimate. A good place to put this is on your website where you list your rates.

You should also put it on the wall of your office. This is the GFE notice suggested by CMS:

You have the right to receive a “Good Faith Estimate” explaining how much your health care will costUnder the law, health care providers need to give patients who don’t have certain types of health care coverage or who are not using certain types of health care coverage an estimate of their bill for health care items and services before those items or services are provided.

|

Right to dispute charges

You also need to publish a straightforward dispute process notice alongside your GFE notice. You can find a notice example at the bottom of the CMS GFE template:

If you are billed for more than this Good Faith Estimate, you have the right to dispute the bill.You may contact the health care provider or facility listed to let them know the billed charges are higher than the Good Faith Estimate. You can ask them to update the bill to match the Good Faith Estimate, ask to negotiate the bill, or ask if there is financial assistance available. You may also start a dispute resolution process with the U.S. Department of Health and Human Services (HHS). If you choose to use the dispute resolution process, you must start the dispute process within 120 calendar days (about 4 months) of the date on the original bill. There is a $25 fee to use the dispute process. If the agency reviewing your dispute agrees with you, you will have to pay the price on this Good Faith Estimate. If the agency disagrees with you and agrees with the health care provider or facility, you will have to pay the higher amount. To learn more and get a form to start the process, go to www.cms.gov/nosurprises or call 1-800-985-3059. For questions or more information about your right to a Good Faith Estimate or the dispute process, visit www.cms.gov/nosurprises or call 1-800-985-3059. |

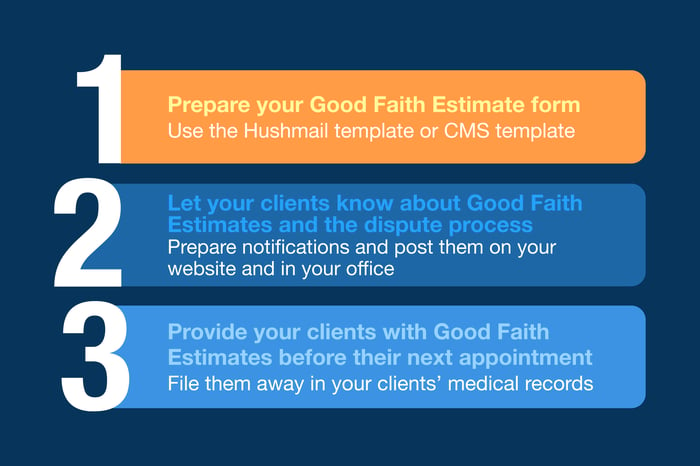

What do practitioners need to do right now?

Now you know the basics about the No Surprises Act and how it affects your practice. So how do you make sure you’re compliant?

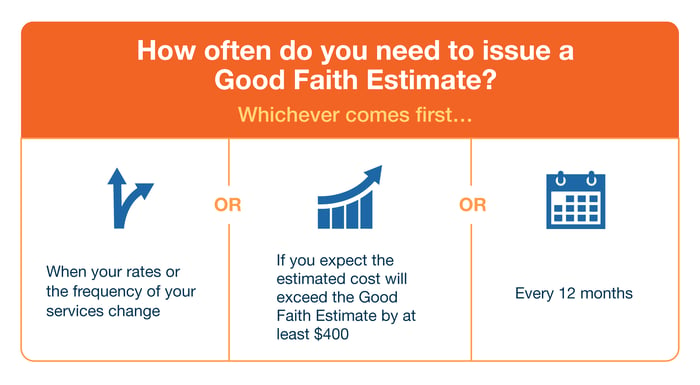

Be sure to keep track of your clients’ charges. If it looks like they’re about to exceed the GFE estimate by $400 within a year, you must issue a new GFE. Also, if your rates change, that must be noted on a new GFE.

No Surprises Act FAQ

The No Surprises Act is complex and affects all healthcare practitioners. While not accepting insurance often reduces paperwork, that isn’t the case here. It might take some time to get used to the new requirements, and you’ll probably wonder if you’re doing everything right.

Here are some of the questions that might come up…

How soon do you have to comply with the No Surprises Act?

The law went into effect on January 1, 2022, so compliance is required immediately.

Do you need to estimate the cost of each session, the number of sessions, or both?

Both. In our GFE template, for each service you provide, we include a place for you to fill in the number of sessions expected in the course of a year (quantity). We also give you a place to fill in the cost of an individual session (cost per unit). By multiplying these two figures, you’ll have the “expected cost,” and we give you a place to fill that in too. Remember, these are estimates only. You can update this information at any time by issuing a new GFE.

Do you need to include the physical address of your practice on the GFE if your practice is virtual?

The law requires you to include the name, NPI, and TIN of each provider or facility represented in the good faith estimate, as well as the state and office location where the services will be furnished. It may be sufficient to name the state where you're practicing, but you should contact legal counsel for clarification.

Do you have to do anything for insured clients?

Not at this time, but the federal government plans to expand the rules to require practitioners to send GFEs to insurers in 2023. Be sure to be on the lookout for updates.

Can a client waive their right to a Good Faith Estimate?

Some clients might want to waive their right to a Good Faith Estimate since it records a diagnosis.

However, according to Steve Youngman, VP of Legal at Hushmail, “there doesn’t seem to be any provision in the legislation allowing clients to waive their right to a Good Faith Estimate. Also, keep in mind that the GFE is part of the client's medical record. The provider must keep it as part of the client’s file for whichever is longer: 1) the state records retention requirement or 2) six years.”

Do your Good Faith Estimates need to be secure?

Yes. Good Faith Estimates contain protected health information (PHI). They should be sent to your clients using a HIPAA-compliant email service like Hushmail for Healthcare. Then, store the GFE securely as part of your client’s medical record.

What about group practices? Does every provider need to provide a separate Good Faith Estimate?

If a client receives services from other providers through you, such as in an addiction treatment clinic, one GFE can be used for all of you. In this case, use the CMS GFE template, which allows for multiple providers.

The hidden benefits of the No Surprises Act

The most apparent benefit of the No Surprises Act is that patients won’t receive surprise bills that may be unaffordable.

But there are some hidden benefits for small practices too, it:

- Provides a natural benchmark to open up the money conversation

- Allows practitioners to adjust sliding scale payments every 12 months

- Ensures that treatment plans are reviewed regularly

- Opens up the conversation about diagnosis

Comply with the No Surprises Act today

Complying with the No Surprises Act is important, but it doesn't have to be complicated.

Just make sure you…

- Publish a right to receive a GFE notice on your website

- Publish a right to dispute charges notice on your website

- Give a Good Faith Estimate to your self-pay clients within 1-3 business days of scheduling their appointment or their request for an estimate

When it comes to your GFEs, the template from CMS might be enough to get you by.

But if you want to be able to deliver them quickly to your clients, take a look at our secure GFE template.

With this template you’ll comply with the No Surprises Act without sacrificing valuable time you’d rather spend with your clients.

If you’re ready to send out your GFEs, sign up for Hushmail and get access to our template today.

Overwhelmed by the business side of private practice? In this guide, therapists share 20 ways they've offloaded what drains them, to create more space for the work they love.